GameStop Price to Earnings Ratio: Understanding the Ups and Downs

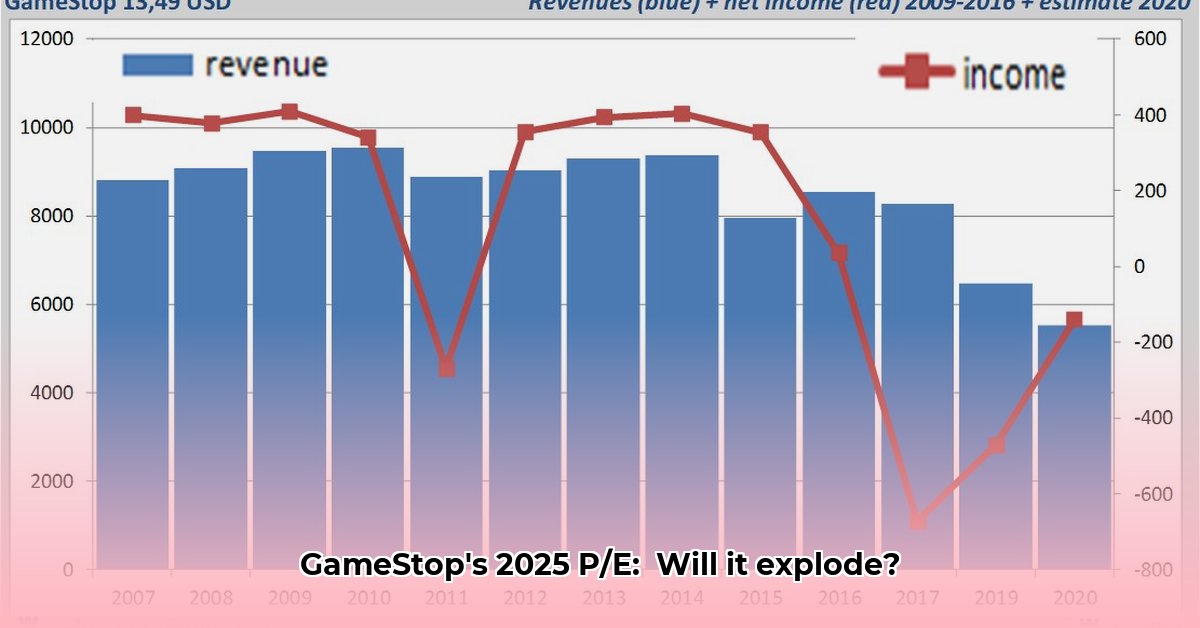

GameStop's (GME) price-to-earnings (P/E) ratio has exhibited extraordinary volatility. This metric, designed to gauge investor sentiment relative to a company's earnings, presents a particularly complex challenge in GameStop's case. Understanding this volatility requires examining the interplay of several significant factors, including the "meme stock" phenomenon, speculative trading, and the company's ambitious business transformation. Recent estimates of GME's P/E ratio have varied wildly, highlighting the need for a nuanced analysis.

What's a P/E Ratio?

The P/E ratio compares a company's stock price to its earnings per share (EPS). A higher P/E suggests investors are willing to pay more for each dollar of earnings, often reflecting optimism about future growth. Calculating it is straightforward: Current Share Price / Earnings Per Share (EPS). However, applying this simple calculation to GameStop reveals the limitations of this metric in the face of exceptional market conditions.

The Rollercoaster Ride of GameStop's P/E Ratio: A Tale of Two Numbers

The extreme fluctuations in GameStop's P/E ratio are not merely accounting anomalies. They stem from a confluence of forces:

The Meme Stock Phenomenon: The intense social media-driven interest in GameStop created a speculative bubble, significantly inflating its stock price and P/E ratio regardless of its underlying financial performance. This highlights the power of collective online sentiment to drive market behavior.

Business Model Transformation: GameStop's shift from brick-and-mortar retail to a digitally focused model, incorporating NFT marketplaces and e-commerce initiatives, introduces significant uncertainty into traditional valuation metrics. The current P/E ratio may not accurately reflect the value of these future endeavors.

Speculative Trading: Short-term, speculative trading activity significantly impacts GameStop's stock price, leading to dramatic P/E ratio swings unrelated to the company’s intrinsic financial health. This short-term focus contrasts with long-term valuation models.

This interplay of factors makes interpreting GameStop's P/E ratio significantly more challenging than for established companies with stable business models.

Impact on Different Stakeholders

GameStop's volatile P/E ratio affects various stakeholders differently:

Retail Investors: The high volatility presents significant risk. Retail investors should exercise extreme caution, diversify their portfolios, and avoid basing investment decisions solely on short-term price fluctuations or online hype.

Institutional Investors: Large investors conduct more thorough due diligence. They consider long-term growth potential, risk assessment, and broader market trends beyond the P/E ratio.

GameStop Management: They must strive for improved financial performance and transparency, aligning their actions with the high market valuation implied by the elevated P/E ratio.

Regulatory Bodies (e.g., SEC): Extreme price volatility necessitates regulatory oversight to ensure fair trading practices and prevent market manipulation.

Risk Assessment and Mitigation Strategies

GameStop faces substantial risks, requiring effective mitigation strategies:

| Risk Factor | Likelihood | Impact | Mitigation Strategies |

|---|---|---|---|

| Failure of Digital Transformation | High | Very Negative | Aggressive investment in technology, talent acquisition, strategic partnerships, and marketing. |

| Increased Competition | Medium | Negative | Focus on niche markets, development of unique offerings, and robust customer loyalty programs. |

| Regulatory Scrutiny | Medium | Negative | Proactive compliance, transparent communication with regulatory bodies. |

| Negative Investor Sentiment | High | Negative | Enhanced transparency, clear communication of progress, active investor relations. |

Regulatory Implications

The volatile P/E ratio raises concerns about potential market manipulation. Regulatory bodies must actively monitor trading activity to ensure fair market practices and investor protection. Transparency from GameStop regarding its financial performance and strategic direction is critical to maintaining market confidence.

Conclusion: A Broader Perspective

GameStop's P/E ratio, while informative, cannot be viewed in isolation. Investors and analysts must assess the company's evolving business model, broader market dynamics, and risk factors. The current P/E ratio doesn't fully encapsulate the company's unique situation, emphasizing the need for a comprehensive approach to valuation rather than relying on a single metric.

Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. Investing in volatile stocks like GameStop carries significant risk. Consult with a qualified financial advisor before making any investment decisions.